- Risk index decreases for the first time since Q3 2016 as lower interest rates brought an influx of low-risk refinances

- iBuyers represent a new wrinkle in the area of fraud detection

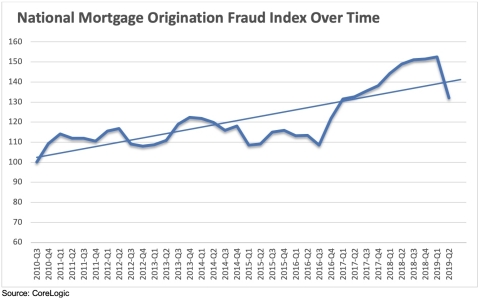

IRVINE, Calif. — (BUSINESS WIRE) — September 11, 2019 — CoreLogic® (NYSE: CLGX), a leading global property information, analytics and data-enabled solutions provider, today released its latest Mortgage Fraud Report. The report shows an 11.4% year-over-year decrease in fraud risk at the end of the second quarter, as measured by the CoreLogic Mortgage Application Fraud Risk Index, which is the first decrease since the third quarter of 2016.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20190911005587/en/

National Mortgage Origination Fraud Index Over Time; CoreLogic 2019

The analysis found that during the second quarter of 2019, an estimated one in 123 mortgage applications, or 0.81% of all applications, contained indications of fraud, compared with the reported one in 109, or 0.91% in the second quarter of 2018.

The CoreLogic Mortgage Fraud Report analyzes the collective level of loan application fraud risk experienced in the mortgage industry each quarter. CoreLogic develops the index based on residential mortgage loan applications processed by CoreLogic LoanSafe Fraud Manager™, a predictive scoring technology. The report includes detailed data for six fraud type indicators that complement the national index: identity, income, occupancy, property, transaction and undisclosed real estate debt.

“The decrease in fraud risk mid-2019 appears temporary, based on unexpected interest rate drops and the resulting influx of low-risk refinance transactions,” said Bridget Berg, principal of Fraud Solutions Strategy for CoreLogic. “The absolute number of risky loans has not decreased but are simply part of a larger mortgage market at this time.”

Report Highlights:

- New York, New Jersey and Florida remain the top three states for mortgage application fraud risk. For the first time since 2017, New Jersey outpaced Florida and moved into the second highest position.

- Eight of the top 10 riskiest states showed stable or decreasing risk over the past year.

- States with the greatest year-over-year risk growth include Idaho, Alabama, Mississippi, New York and Delaware. States with the largest decreases include Kansas, Missouri, Massachusetts, Illinois and New Mexico.

- Jumbo loans for home purchases is the only segment showing a risk increase.

- Nationally, all fraud types showed decreased risk. Undisclosed Real Estate Debt fraud risk had the greatest decrease year over year, followed by decreases in Property and Income fraud types.

- iBuyers — or companies that use technology to instantly make an offer on a home — accounted for more than 1% of all home sales in 2018 and are a contributing factor in the overall decline of fraud risk.

To view the full CoreLogic Mortgage Fraud Report, visit www.corelogic.com/mortgagefraudreport.

Methodology

Our comprehensive fraud risk analysis is based on a lender-driven mortgage fraud consortium and leading predictive-scoring technology.

The CoreLogic Mortgage Application Fraud Risk Index represents the collective level of fraud risk the mortgage industry is experiencing in each time period, based on the share of loan applications with a high risk of fraud. The index is standardized to a baseline of 100 for the share of high-risk loan applications nationally in the third quarter of 2010.

The Fraud Type Indicators are based on specific CoreLogic LoanSafe Fraud Manager alerts. These alerts are compiled consistently for all CoreLogic Mortgage Fraud Consortium members. Indicator levels are based on the prevalence and predictive ability of the relevant alerts. An increase in the indicator correlates with increased risk of the corresponding fraud type.

Source: CoreLogic

The data provided is for use only by the primary recipient or the primary recipient's publication or broadcast. This data may not be re-sold, republished or licensed to any other source, including publications and sources owned by the primary recipient's parent company without prior written permission from CoreLogic. Any CoreLogic data used for publication or broadcast, in whole or in part, must be sourced as coming from CoreLogic, a data and analytics company. For use with broadcast or web content, the citation must directly accompany first reference of the data. If the data is illustrated with maps, charts, graphs or other visual elements, the CoreLogic logo must be included on screen or website. For questions, analysis or interpretation of the data, contact Allyse Sanchez at Email Contact. Data provided may not be modified without the prior written permission of CoreLogic. Do not use the data in any unlawful manner. This data is compiled from public records, contributory databases and proprietary analytics, and its accuracy is dependent upon these sources.

About CoreLogic

CoreLogic (NYSE: CLGX), the leading provider of property insights and solutions, promotes a healthy housing market and thriving communities. Through its enhanced property data solutions, services and technologies, CoreLogic enables real estate professionals, financial institutions, insurance carriers, government agencies and other housing market participants to help millions of people find, acquire and protect their homes. For more information, please visit www.corelogic.com.

CORELOGIC, the CoreLogic logo, and LoanSafe Fraud Manager are trademarks of CoreLogic, Inc. and/or its subsidiaries. All other trademarks are the property of their respective owners.

View source version on businesswire.com: https://www.businesswire.com/news/home/20190911005587/en/

Contact:

Media Contact:

Allyse Sanchez

INK Communications

925-548-2535

Email Contact