- The U.S. serious delinquency rate reached its lowest level since June 2000

- North Carolina and Mississippi posted the largest annual declines in overall delinquency rate

- The nation's overall delinquency rate fell on a year-over-year basis for the 24th consecutive month in December 2019

IRVINE, Calif. — (BUSINESS WIRE) — March 10, 2020 — CoreLogic® (NYSE: CLGX), a leading global property information, analytics and data-enabled solutions provider, today released its monthly Loan Performance Insights Report. The report shows that nationally, 3.7% of mortgages were in some stage of delinquency (30 days or more past due, including those in foreclosure) in December 2019, representing a 0.4 percentage point decline in the overall delinquency rate compared with December 2018, when it was 4.1%. This was the lowest for a December in more than 20 years.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20200310005286/en/

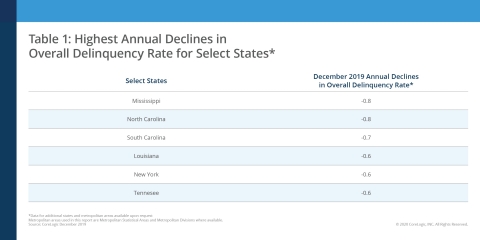

Highest Annual Declines in Overall Delinquency Rate for Select States; CoreLogic December 2019 (Graphic: Business Wire)

As of December 2019, the foreclosure inventory rate, which measures the share of mortgages in some stage of the foreclosure process, was 0.4% – unchanged from December 2018. Last December’s foreclosure inventory rate tied the prior 13 months as the lowest for any month since at least January 1999.

Measuring early-stage delinquency rates is important for analyzing the health of the mortgage market. To monitor mortgage performance comprehensively, CoreLogic examines all stages of delinquency, as well as transition rates, which indicate the percentage of mortgages moving from one stage of delinquency to the next.

The rate for early-stage delinquencies – defined as 30 to 59 days past due – was 1.8% in December, down from 2% in December 2018. The share of mortgages 60 to 89 days past due in December was 0.6%, down from 0.7% in December 2018. The serious delinquency rate – defined as 90 days or more past due, including loans in foreclosure – was 1.2% in December, down from 1.5% in December 2018. This is the lowest serious delinquency rate experienced since June 2000.

Since early-stage delinquencies can be volatile, CoreLogic also analyzes transition rates. The share of mortgages that transitioned from current to 30 days past due was 0.8% in December, down from 0.9% in December 2018. By comparison, just before the start of the financial crisis in January 2007, the current-to-30-day transition rate was 1.2%, and peaked at 2% in November 2008.

“The CoreLogic HPI shows home price growth quickened during the last few months of 2019, padding the home equity cushion for owners,” said Dr. Frank Nothaft, chief economist at CoreLogic. “Our HPI Forecast for 2020 anticipates a further pickup in appreciation, adding to home-equity wealth for owners and lowering foreclosure risk.”

No states posted a year-over-year increase in the overall delinquency rate in December. The states that logged the largest annual decreases included North Carolina and Mississippi (both down 0.8 percentage points). South Carolina (down 0.7 percentage points) experienced the third-largest annual decrease, followed by Louisiana, New York and Tennessee (all down 0.6 percentage points).

Thirteen metropolitan areas recorded small annual increases in overall delinquency rates. The largest annual increases were in Janesville-Beloit, Wisconsin (up 1.9 percentage points); Enid, Oklahoma (up 0.6 percentage points) and Pine Bluff, Arkansas (up 0.6 percentage points). The other 10 metro areas experienced increases between 0.1 and 0.2 percentage points.

While the nation’s serious delinquency rate reached a near 20-year low in December, 16 metro areas recorded at least a small annual increase. Enid, Oklahoma logged the largest increase (up 0.4 percentage points), followed by Pine Bluff, Arkansas (up 0.3 percentage points); Dubuque, Iowa (up 0.2 percentage points) and St. Joseph, Missouri-Kansas (up 0.2 percentage points). The other 12 metro areas logged increases of 0.1 percentage points.

“The mortgage market had another solid year in 2019, and loan performance across the country continues to show improvement,” said Frank Martell, president and CEO of CoreLogic. “The longest economic expansion in history helped serious delinquency rates reach a 20-year low. As mortgage rates continue to fall in the wake of recent global events, we may see homeowners refinance into lower-monthly payments, or into shorter-term mortgages, which can further reduce delinquency and foreclosure risk.”

The next CoreLogic Loan Performance Insights Report will be released on April 14, 2020, featuring data for January 2020.

For ongoing housing trends and data, visit the CoreLogic Insights Blog: www.corelogic.com/insights.

Methodology

The data in this report represents foreclosure and delinquency activity reported through December 2019.

The data in this report accounts for only first liens against a property and does not include secondary liens. The delinquency, transition and foreclosure rates are measured only against homes that have an outstanding mortgage. Homes without mortgage liens are not typically subject to foreclosure and are, therefore, excluded from the analysis. Approximately one-third of homes nationally are owned outright and do not have a mortgage. CoreLogic has approximately 85% coverage of U.S. foreclosure data.

Source: CoreLogic

The data provided is for use only by the primary recipient or the primary recipient's publication or broadcast. This data may not be re-sold, republished or licensed to any other source, including publications and sources owned by the primary recipient's parent company without prior written permission from CoreLogic. Any CoreLogic data used for publication or broadcast, in whole or in part, must be sourced as coming from CoreLogic, a data and analytics company. For use with broadcast or web content, the citation must directly accompany first reference of the data. If the data is illustrated with maps, charts, graphs or other visual elements, the CoreLogic logo must be included on screen or website. For questions, analysis or interpretation of the data, contact Allyse Sanchez at corelogic@ink-co.com. Data provided may not be modified without the prior written permission of CoreLogic. Do not use the data in any unlawful manner. This data is compiled from public records, contributory databases and proprietary analytics, and its accuracy is dependent upon these sources.

About CoreLogic

CoreLogic (NYSE: CLGX), the leading provider of property insights and solutions, promotes a healthy housing market and thriving communities. Through its enhanced property data solutions, services and technologies, CoreLogic enables real estate professionals, financial institutions, insurance carriers, government agencies and other housing market participants to help millions of people find, acquire and protect their homes. For more information, please visit www.corelogic.com.

CORELOGIC and the CoreLogic logo are trademarks of CoreLogic, Inc. and/or its subsidiaries. All other trademarks are the property of their respective owners.

View source version on businesswire.com: https://www.businesswire.com/news/home/20200310005286/en/

Contact:

Allyse Sanchez

INK Communications

925-548-2535

corelogic@ink-co.com