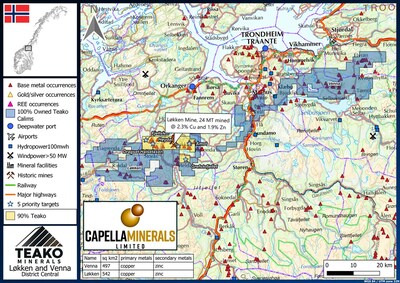

Capella's Løkken project covers 114 sq. km and contains the past-producing Løkken copper-zinc mining operation, the largest Cyprus-type massive sulfide ("VMS") deposit known globally with reported past production of 24MT @ 2.3% Cu + 1.9% Zn1). In addition, the Løkken project contains the drill-ready Åmot VMS target and multiple satellite target areas with the potential for further Løkken-type VMS discoveries (see Company News Release dated July 22, 2024).

Terms of the Agreement

Key terms of the Agreement under which Teako will acquire a 90% interest in the Løkken project include:

i) Capella to receive $C 350,000 in cash and 2,500,000 common Teako shares on or before August 30, 2024.

ii) Teako to commit to drilling the Åmot target with new funds raised within twelve months of signing the Agreement, in addition to advancing at least two further targets to drill-ready status within 24 months from signing.

iii) Teako to pay Capella a further $C 1,250,000 upon a Final Investment Decision ("FID") being made to proceed to the construction of a mine within the Løkken project.

iv) Capella to retain a 10% carried interest to production, which includes capital costs, on any discovery made within the Løkken project.

v) Teako to keep the property in good standing and to make all annual advanced royalty payments to EMX Royalty Corporation ("EMX") starting 30 September, 2024.

vi) Customary tag along / drag along rights, with Capella maintaining at all times a Right of First Refusal ("ROFR") on any bona fide third-party offer received for Teako's interest in the Løkken project.

In the event that Teako makes a Final Investment Decision to proceed with commercial production, Capella and Teako will then enter into a Joint Venture Agreement ("JV Agreement"). As part of this JV Agreement, Capella will not be required to make any contributions to the mine capital costs until commercial production commences (at which time Capella will be required to payback its share of capital costs by netting out 25% of the amount of any distribution to Capella until such amounts are recovered). Should the mine close prior to final repayment, the balance outstanding payable by Capella will be forgiven clear of any further obligations.

Eric Roth, Capella's President and CEO, commented: "Today, we are very pleased to be announcing this Agreement with Teako, which will allow the Løkken project to advance through further exploration and drilling – including at the drill-ready Åmot target – in addition to creating a significant district-scale exploration and development project through the combination of Løkken with Teako's adjacent Lomunda and Venna projects. Capella shareholders also retain a direct interest in any discovery at Løkken all the way through to production, and also benefit from exploration success by Teako – both within the Løkken district and elsewhere throughout Norway – through our Teako shareholding which will now total 3,500,000 common Teako shares.

Capella looks forward to working together with Teako's technical / management team, with whom a solid relationship has already been built through joint efforts at the Vaddas-Birtavarre project in northern Norway, in order to ensure success for all parties at Løkken. I do look forward to keeping the market updated as our exploration programs advance".

About the Combined Løkken and Lomunda-Venna Projects

Capella's Løkken project covers an area of 114 sq. km and includes the former mining operations at Løkken, Høydal, and Dragset. Copper production from the former Løkken mine ceased in 1986 in response to low metals prices, thereby leaving potential for new high-grade VMS discoveries in both extensions to the original Løkken mine and in satellite bodies. The main host rocks to mineralization at Løkken are pillow basalts and gabbro; similar lithologies follow a broadly SW-NE regional trend and have been covered by Teako's Lomunda and Venna claims (Figure 1).

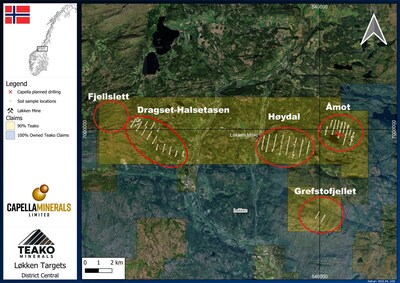

At the Løkken project, Capella's exploration activities have identified 5 priority target areas located in the immediately vicinity of the former Løkken mine (Figure 2). These targets include the previously-undrilled Åmot target, which is located approximately 5km E of the former Løkken mining operations and defined by coincident ground magnetic, airborne EM, and soil geochemical anomalies (all favourable indicators for VMS deposits). The Company interprets the Åmot target from geophysical data to lie approximately 150m vertically below surface.

1 Historic production values quoted for Løkken are from Grenne T, Ihlen PM, Vokes FM (1999) Scandinavian Caledonide metallogeny in a plate-tectonic perspective. Mineral Deposita 34:422–471. Capella has not performed sufficient work to verify the published data reported above, but the Company believes this information to be considered reliable and relevant. |

Qualified Persons and Disclosure Statement

The technical information in this news release relating to the Løkken project has been prepared in accordance with Canadian regulatory requirements set out in NI 43-101, and approved by Eric Roth, the Company's President & CEO, a Director, and a Qualified Person under NI 43-101. Mr. Roth holds a Ph.D. in Economic Geology from the University of Western Australia, is a Fellow of the Australian Institute of Mining and Metallurgy (AusIMM) and is a Fellow of the Society of Economic Geologists (SEG). Mr. Roth has 35 years of experience in international minerals exploration and mining project evaluation.

On Behalf of the Board of Capella Minerals Ltd.

"Eric Roth"

___________________________

Eric Roth, Ph.D., FAusIMM

President & CEO

About Capella Minerals Ltd

Capella is a Canadian exploration and development company with a focus on copper-gold projects in the Central Lapland Greenstone Belt of northern Finland & copper-cobalt projects in Norway.

In northern Finland, the Company's portfolio consists of 5 copper-gold projects – including the priority Killero E and Killero W projects, both of which were former Anglo American targets but never drilled - and which are located about 40km SW of Agnico Eagle's Kittilä Gold Mine, currently the largest gold producer in Europe.