- All 50 States Gained Value YOY in February, Increasing the Most in Washington, with 12.5 Percent

- In February, 48 Percent of the Top 50 Markets Were Considered Overvalued

- Home Prices Projected to Increase by 4.7 Percent by February 2019

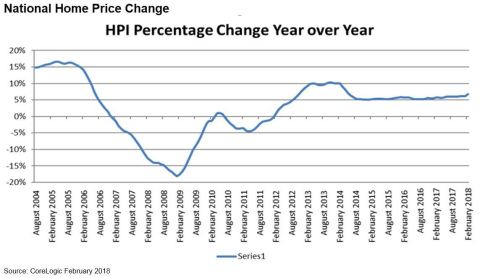

IRVINE, Calif. — (BUSINESS WIRE) — April 3, 2018 — CoreLogic® (NYSE: CLGX), a leading global property information, analytics and data-enabled solutions provider, today released the CoreLogic Home Price Index (HPI™) and HPI Forecast™ for February 2018, which shows home prices rose both year over year and month over month. Home prices increased nationally year over year by 6.7 percent — from February 2017 to February 2018 — and on a month-over-month basis, home prices increased by 1 percent in February 2018 — compared with January 2018 — according to the CoreLogic HPI. (January 2018 data were revised. Revisions with public records data are standard, and to ensure accuracy, CoreLogic incorporates the newly released public data to provide updated results each month.)

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20180403005431/en/

CoreLogic National Home Price Change; February 2018. (Graphic: Business Wire)

Looking ahead, the CoreLogic HPI Forecast indicates that the national home-price index is projected to continue to increase by 4.7 percent on a year-over-year basis from February 2018 to February 2019, with California leading the climb at a forecasted 10.3 percent year-over-year change. The CoreLogic HPI Forecast is a projection of home prices that is calculated using the CoreLogic HPI and other economic variables. Values are derived from state-level forecasts by weighting indices according to the number of owner-occupied households for each state.

“A number of western states have had hot housing markets,” said Dr. Frank Nothaft, chief economist for CoreLogic. “Idaho, Nevada, Utah and Washington all had home prices up more than 11 percent over the last year. With the recent rise in mortgage rates, affordability has fallen sharply in these states. We expect home-price growth to slow over the next 12 months, dropping to 5 to 6 percent in Idaho, Utah and Washington, and slowing to 9.6 percent in Nevada.”

According to CoreLogic Market Condition Indicators (MCI) data, an analysis of housing values in the country’s 100 largest metropolitan areas based on housing stock, 34 percent of metropolitan areas have an overvalued housing market as of February 2018. The MCI analysis categorizes home prices in individual markets as undervalued, at value or overvalued, by comparing home prices to their long-run, sustainable levels, which are supported by local market fundamentals (such as disposable income). Additionally, as of February 2018, 30 percent of the top 100 metropolitan areas were undervalued and 36 percent were at value. When looking at only the top 50 markets based on housing stock, 48 percent were overvalued, 18 percent were undervalued and 34 percent were at value. The MCI analysis defines an overvalued housing market as one in which home prices are at least 10 percent higher than the long-term, sustainable level, while an undervalued housing market is one in which home prices are at least 10 percent below the sustainable level.

“Family income is rising more slowly than home prices and mortgage rates, meaning that the mortgage payment takes a bigger bite out of income for new homebuyers,” said Frank Martell, president and CEO of CoreLogic. “CoreLogic’s Market Conditions Indicator has identified nearly one-half of the 50 largest metropolitan areas as overvalued. Often buyers are lulled into thinking these high-priced markets will continue, but we find that overvalued markets will tend to have a slowdown in price growth.”

Methodology

The CoreLogic HPI™ is built on industry-leading public record, servicing and securities real-estate databases and incorporates more than 40 years of repeat-sales transactions for analyzing home price trends. Generally released on the first Tuesday of each month with an average five-week lag, the CoreLogic HPI is designed to provide an early indication of home price trends by market segment and for the “Single-Family Combined” tier representing the most comprehensive set of properties, including all sales for single-family attached and single-family detached properties. The indexes are fully revised with each release and employ techniques to signal turning points sooner. The CoreLogic HPI provides measures for multiple market segments, referred to as tiers, based on property type, price, time between sales, loan type (conforming vs. non-conforming) and distressed sales. Broad national coverage is available from the national level down to ZIP Code, including non-disclosure states.

CoreLogic HPI Forecasts™ are

based on a two-stage, error-correction econometric model that combines

the equilibrium home price—as a function of real disposable income per

capita—with short-run fluctuations caused by market momentum,

mean-reversion, and exogenous economic shocks like changes in the

unemployment rate. With a 30-year forecast horizon, CoreLogic HPI

Forecasts project CoreLogic HPI levels for two tiers—“Single-Family

Combined” (both attached and detached) and “Single-Family Combined

Excluding Distressed Sales.” As a companion to the CoreLogic HPI

Forecasts, Stress-Testing Scenarios align with Comprehensive Capital

Analysis and Review (CCAR) national scenarios to project five years of

home prices under baseline, adverse and severely adverse scenarios at

state, Core Based Statistical Area (CBSA) and ZIP Code levels. The

forecast accuracy represents a 95-percent statistical confidence

interval with a +/- 2.0 percent margin of error for the index.