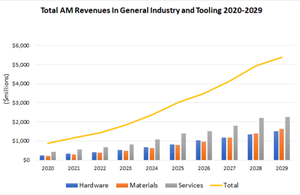

CROZET, Va., March 10, 2020 (GLOBE NEWSWIRE) -- SmarTech Analysis, the leading provider of industry analysis and market consulting services to the additive manufacturing industry has just issued a new report on the additive general industry and tooling market. The study reports the growing adoption of AM technologies by key equipment manufacturers, industrial parts suppliers and AM service providers catering to the general industry and tooling sector. The report found that total revenue generation associated with the additive general industry and tooling market will reach $5.48 billion in 2029, including a $1.6 billion yearly revenue opportunity from AM hardware sales.

More details of the report, “Market Opportunities for Additive Manufacturing in the General Industry and Tooling Sector-2020-2029” including a table of contents and sample can be found at: https://www.smartechanalysis.com/reports/market-opportunities-for-additive-manufacturing-in-the-general-industry-and-tooling-sector-2020-2029/

About the Report:

This report on additive manufacturing in the general industry and tooling sector features data-driven analysis on the past, present and future characteristics of the industry and the revenue generating opportunities that result from it.

The study provides an assessment of the overall AM opportunity for the general industry and tooling sector, involving both existing and emerging metal and polymer AM processes that will see increased adoption over the 10-year forecast period. This includes leading polymer and metal AM processes used for prototyping, tooling and end parts along with emerging high-throughput technologies such as large-scale continuous vat photopolymerization and metal binder jetting techniques.

SmarTech also profiles leading adopters of AM in the general industry and tooling sector, emphasizing the adoption trends that these manufacturers are following, including the use of 3D-printed spare parts as a gateway to end part production. Analyzing these trends, we don’t expect widespread adoption of AM in the general industry and tooling market to be driven by one individual segment of AM (i.e., hardware, materials or services), but we do anticipate specific technologies, materials and service providers within these segments to drive growth.

Companies mentioned include: Carbon, EOS, HP, Xaar, Caterpillar, Volvo Construction Equipment, GE Additive, Siemens, Sandvik, Desktop Metal, Markforged, Parmatech, Kennametal, Phoenix Contact, Mapal, Guhring UK, GKN Additive, Kueppers Solutions, CNH Industrial, Cummins Inc., Wabtec, Emerson Electric, Xylem, Additive Industries, SMS Group

From the Report:

- Industrial manufacturers are increasingly looking to digitize their supply chains. As general industry and tooling stakeholders turn toward increased automation and digitization, AM will become increasingly adopted.

- Use of AM for general industry is already well developed and will continue along the standard adoption path associated with AM in other industries, with companies first deploying the technology for prototyping, followed by the fabrication of tooling, and then moving into production.

- Polymer AM will play a leading role in the general industry and tooling sector, due to its already large install base for prototyping and the production of jigs and fixtures; however, new, lower-priced material extrusion systems capable of printing with high-temperature, high-performance plastics will further spur this growth, as well. So, too, will the increased adoption and development of continuous DLP vat photopolymerization and high-throughput polymer powder bed fusion technologies. Total revenues for polymer extrusion 3D printers are projected to reach $722 million by the end of the forecast period.

- Metal AM, including both hardware and materials, will grow at a rapid pace as the technology is used for the production of molds and, increasingly, end parts. At $557 million annually by 2029, metal PBF represents the largest revenue opportunity for metal AM hardware due to the cost of technology.

- 3D-printed molds and dies will play a unique role in the general industry and tooling sector, as mold and die manufacturers are becoming pathways for introducing AM technology to the broader sector, as well as the benefits AM brings to the production of molds and dies, such as conformal cooling, topology optimization, and repairs and upgrades using 3D-printed inserts.

About SmarTech Analysis:

Since 2013 SmarTech Analysis has published reports on all the important revenue opportunities in the 3D printing/additive manufacturing sector and is considered the leading industry analyst firm providing coverage of this sector. SmarTech analysis and data drives strategy development in the additive industry, and has been adopted and presented by many of the industry’s largest firms.

For more details on our company go to

www.smartechanalysis.com

Contact:

Robert Nolan

SmarTech Analysis

(804) 938-0030

rob@smartechanalysis.com

An image accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/2fca1d9c-5cd4-4616-b0e5-a99efee32efe