Live Sinter Software to Be Available Initially with the Desktop Metal Shop System and Production System Platforms

- Sintering process simulation software corrects for shrinkage and distortion of binder jet 3D printed parts during sintering, minimizing trial and error

- Live Sinter results in near-net shape parts after sintering, achieving tight shape and dimensional tolerances while diminishing or eliminating the need for sintering supports

- Live Sinter offers additive manufacturing engineers fast and predictable sintering outcomes, with simulations results in as little as five minutes and negative offset geometries in as few as twenty minutes.

BOSTON — (BUSINESS WIRE) — November 6, 2020 — Desktop Metal, a leader in mass production and turnkey additive manufacturing solutions, today is launching Live Sinter™, a software solution designed to eliminate the trial and error required to achieve high-accuracy parts via powder metallurgy-based additive manufacturing processes like binder jetting.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20201106005037/en/

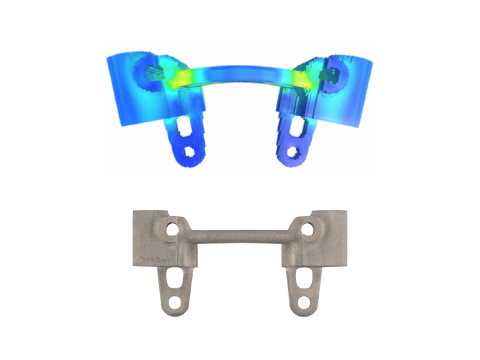

A breakthrough software application, Live Sinter offers additive manufacturing engineers fast and predictable sintering outcomes of 3D printed metal parts. (Photo: Business Wire)

The software launch follows Desktop Metal’s recent signing of a definitive business combination agreement with Trine Acquisition Corp. (NYSE: TRNE), to accelerate its go-to-market efforts and further drive its relentless efforts in advanced R&D.

A breakthrough software application, Live Sinter not only corrects for the shrinkage and distortion parts typically experience during sintering, but also opens the door to printing geometries that, without the software, would present significant challenges to sinter. By improving the shape and dimensional tolerances of sintered parts, first-time part success for complex geometries is improved and the cost and time associated with post-processing are minimized. In many cases, the software even enables parts to be sintered without the use of supports.

While compatible with any sintering-based powder metallurgy process, including metal injection molding (MIM), Live Sinter will first be available to customers of Desktop Metal’s Shop System™, shipping in late 2020, and Production System™, shipping in 2021.

“The manufacturing industry is witnessing the transformative power that additive manufacturing has across many industries, from automotive and aerospace, to heavy machinery and consumer products with respect to quality, performance, and cost savings. We believe Live Sinter will be a critical companion in continuing to drive forward the success of additive manufacturing,” said Ric Fulop, CEO and co-founder of Desktop Metal. “As manufacturers look to capitalize on the flexibility of volume production delivered through technologies such as binder jetting, Live Sinter is a first-of-its-kind solution that offers a path to predictable and repeatable outcomes by demystifying the sintering process.”

Challenges of Sintering & Powder Metallurgy-based Additive Manufacturing

Sintering is a critical step in powder metallurgy-based manufacturing processes, including binder jetting. It involves heating parts to near melting in order to impart strength and integrity, and typically causes parts to shrink by as much as 20 percent from their original printed or molded dimensions. During the process, improperly supported parts also face significant risk of deformation, resulting in parts that emerge from the furnace cracked, distorted, or requiring costly post-processing to achieve dimensional accuracy.

Sintering distortion has been a reality for the powder metallurgy industry for decades. For much of that time, the solution has been to rely on the experience of industry veterans who, based on repeated trial and error, combine adjustments to part designs with various sintering supports, or “setters”, to enable stable, high-volume production. Live Sinter changes the game by minimizing the reliance on trial and error and offering a streamlined, easy-to-use software solution that delivers accurate parts without requiring users to be experts in powder metallurgy.

Software-generated “Negative Offset” Geometry Compensates for Distortion

Developed in collaboration with Desktop Metal materials scientists, Live Sinter can be calibrated to a variety of alloys. It predicts the shrinkage and distortion that parts undergo during sintering, and automatically compensates for such changes, creating “negative offset” geometries that, once printed, will sinter to the original, intended design specifications. These negative offsets are the result of a GPU-accelerated iterative process, in which the software proactively pre-deforms part geometries by precise amounts in specific directions, allowing them to achieve their intended shape as they sinter.

Sintering simulation is a complex multi-physics problem that involves modeling how parts and materials respond to a number of factors, including gravity, shrinkage, density variations, elastic bending, plastic deformation, friction drag, and more. Moreover, the thermodynamic and mechanical transformations that occur during sintering take place under intense heat, making them difficult to observe without either halting the sintering process mid-cycle or installing windows in the furnace to observe distortions from images taken at high temperature. While such methods are potentially tolerable in R&D environments, they create significant delays and costs in time to market for production applications.

“Live Sinter was developed by joining forces with - instead of fighting against - sintering-based challenges. In doing so, the software generates negative offset part geometries that sinter to the intended shapes and dimensional specifications,” said Andy Roberts, Desktop Metal VP of Software. “It also tackles some of sintering’s biggest challenges, such as the use of setters. For years, creating setters that prop up parts in the furnace relied on the intuition of few engineers with years of hands-on experience. Now, the process is easier, more predictable, and more controllable using Live Sinter.”

High-speed Simulation Powered by GPUs and Streamlined Calibration

Live Sinter runs on a GPU-accelerated multi-physics engine, capable of modeling collisions and interactions between hundreds of thousands of connected particle masses and rigid bodies. The multi-physics engine’s dynamic simulation is refined using an integrated meshless finite element analysis (FEA), which computes stress, strain, and displacement across part geometries used to predict not only shrinkage and deformation, but also risks and failures, validating the feasibility of a part for sintering-based additive manufacturing before the build begins.

Armed with this dual-engine approach, which strikes a balance between speed and accuracy, Live Sinter can simulate a typical sintering furnace cycle in as little as five minutes and generate negative offset geometries that compensate for shrinkage and distortion in as little as fifteen minutes, compared to more general-purpose simulation tools that use complex meshes and require complex setups and hours to complete. Moreover, the software can be calibrated to new materials and sintering hardware and process parameters with minimal additional effort.

Bundled with Desktop Metal Binder Jetting Technology

Live Sinter will first be available in Q4 2020 to customers of Desktop Metal’s Shop System and Production System additive manufacturing solutions. In time, the Company may offer the process simulation software to users of any sintering-based powder metallurgy process.

The Shop System is designed to bring metal additive manufacturing to machine and job shops with an affordable, turnkey solution that achieves exceptional surface finish parts with rich feature detail at speeds up to 10 times those of legacy powder bed fusion additive manufacturing technologies. Created by leading inventors of binder jetting and single-pass inkjet technology, the Production System is designed to be the fastest way to 3D print metal parts at scale. The system is an industrial manufacturing solution designed to achieve speeds up to 100 times those of legacy powder bed fusion additive manufacturing technologies, enabling production quantities of up to millions of parts per year at costs competitive with conventional mass production techniques.

Desktop Metal, which is celebrating its fifth year anniversary in the fall 2020, recently signed a definitive business combination agreement with Trine Acquisition Corp. (NYSE: TRNE), a special purpose acquisition company led by Leo Hindery, Jr., and HPS Investment Partners, a global credit investment firm with over $60 billion in assets under management. For more information, visit www.trineacquisitioncorp.com.

About Desktop Metal

Desktop Metal, Inc., based in Burlington, Massachusetts, is accelerating the transformation of manufacturing with an expansive portfolio of 3D printing solutions, from rapid prototyping to mass production. Founded in 2015 by leaders in advanced manufacturing, metallurgy, and robotics, the company is addressing the unmet challenges of speed, cost, and quality to make Additive Manufacturing an essential tool for engineers and manufacturers around the world. Desktop Metal was selected as one of the world’s 30 most promising Technology Pioneers by the World Economic Forum and named to MIT Technology Review’s list of 50 Smartest Companies. For more information, visit www.desktopmetal.com.

Forward-Looking Statements Legend

This document contains certain forward-looking statements within the meaning of the federal securities laws with respect to the proposed transaction between Desktop Metal, Inc. ("Desktop") and Trine Acquisition Corp. ("Trine"), including statements regarding the benefits of the transaction, the anticipated timing of the transaction, the services offered by Desktop and the markets in which it operates, and Desktop’s projected future results. These forward-looking statements generally are identified by the words “believe,” “project,” “expect,” “anticipate,” “estimate,” “intend,” “strategy,” “future,” “opportunity,” “plan,” “may,” “should,” “will,” “would,” “will be,” “will continue,” “will likely result,” and similar expressions. Forward-looking statements are predictions, projections and other statements about future events that are based on current expectations and assumptions and, as a result, are subject to risks and uncertainties. Many factors could cause actual future events to differ materially from the forward-looking statements in this document, including but not limited to: (i) the risk that the transaction may not be completed in a timely manner or at all, which may adversely affect the price of Trine’s securities, (ii) the risk that the transaction may not be completed by Trine’s business combination deadline and the potential failure to obtain an extension of the business combination deadline if sought by Trine, (iii) the failure to satisfy the conditions to the consummation of the transaction, including the adoption of the agreement and plan of merger by the shareholders of Trine and Desktop, the satisfaction of the minimum trust account amount following redemptions by Trine’s public shareholders and the receipt of certain governmental and regulatory approvals, (iv) the lack of a third party valuation in determining whether or not to pursue the proposed transaction, (v) the occurrence of any event, change or other circumstance that could give rise to the termination of the agreement and plan of merger, (vi) the effect of the announcement or pendency of the transaction on Desktop’s business relationships, performance, and business generally, (vii) risks that the proposed transaction disrupts current plans of Desktop and potential difficulties in Desktop employee retention as a result of the proposed transaction, (viii) the outcome of any legal proceedings that may be instituted against Desktop or against Trine related to the agreement and plan of merger or the proposed transaction, (ix) the ability to maintain the listing of Trine’s securities on the New York Stock Exchange, (x) the price of Trine’s securities may be volatile due to a variety of factors, including changes in the competitive and highly regulated industries in which Desktop plans to operate, variations in performance across competitors, changes in laws and regulations affecting Desktop’s business and changes in the combined capital structure, (xi) the ability to implement business plans, forecasts, and other expectations after the completion of the proposed transaction, and identify and realize additional opportunities, and (xii) the risk of downturns in the highly competitive additive manufacturing industry. The foregoing list of factors is not exhaustive. You should carefully consider the foregoing factors and the other risks and uncertainties described in the “Risk Factors” section of Trine’s Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, the registration statement on Form S-4 and proxy statement/consent solicitation statement/prospectus discussed below and other documents filed by Trine from time to time with the U.S. Securities and Exchange Commission (the “SEC”). These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and Desktop and Trine assume no obligation and do not intend to update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise. Neither Desktop nor Trine gives any assurance that either Desktop or Trine will achieve its expectations.

Additional Information and Where to Find It

This document relates to a proposed transaction between Desktop and Trine. This document does not constitute an offer to sell or exchange, or the solicitation of an offer to buy or exchange, any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, sale or exchange would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. In connection with the proposed transaction, Trine filed a registration statement on Form S-4 with the SEC on September 15, 2020, which included a proxy statement of Trine, a consent solicitation statement of Desktop and a prospectus of Trine. Trine also will file other documents regarding the proposed transaction with the SEC. Before making any voting decision, investors and security holders of Trine are urged to read the registration statement, the proxy statement/consent solicitation statement/prospectus and all other relevant documents filed or that will be filed with the SEC in connection with the proposed transaction as they become available because they will contain important information about the proposed transaction.

Investors and security holders may obtain free copies of the proxy statement/consent solicitation statement/prospectus and all other relevant documents filed or that will be filed with the SEC by Trine through the website maintained by the SEC at www.sec.gov. In addition, the documents filed by Trine may be obtained free of charge from Trine’s website at www.trineacquisitioncorp.com or by written request to Trine at Trine Acquisition Corp., 405 Lexington Avenue, 48th Floor, New York, NY 10174.

Participants in Solicitation

Trine and Desktop and their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from Trine’s stockholders in connection with the proposed transaction. Additional information regarding the interests of those persons and other persons who may be deemed participants in the proposed transaction may be obtained by reading the proxy statement/consent solicitation statement/prospectus regarding the proposed transaction. You may obtain a free copy of these documents as described in the preceding paragraph.

No Offer or Solicitation

This communication is not intended to and shall not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote of approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

View source version on businesswire.com: https://www.businesswire.com/news/home/20201106005037/en/

Contact:

Desktop Metal

Lynda McKinney

978-224-1282

lyndamckinney@desktopmetal.com