Warns Shareholders Not to Be Fooled by Yoav Stern; Nano Continues to Make Misleading Claims

Nano’s Campaign Risks Derailing Stratasys’ Future Growth Opportunities and Threatens to Destroy Value for Stratasys Shareholders

Urges Shareholders to Vote on the WHITE Proxy Card Today “FOR” the Re-Election of Each of Stratasys’ Director Nominees and “AGAINST” Each of Nano’s Unqualified Nominees

MINNEAPOLIS & REHOVOT, Israel — (BUSINESS WIRE) — July 26, 2023 — Stratasys Ltd. (Nasdaq: SSYS) (“Stratasys” or the “Company”), a leader in polymer 3D printing solutions, today mailed a letter to shareholders in connection with Stratasys’ Annual General Meeting of Shareholders (the “Meeting”) that will take place on August 8, 2023.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20230726265287/en/

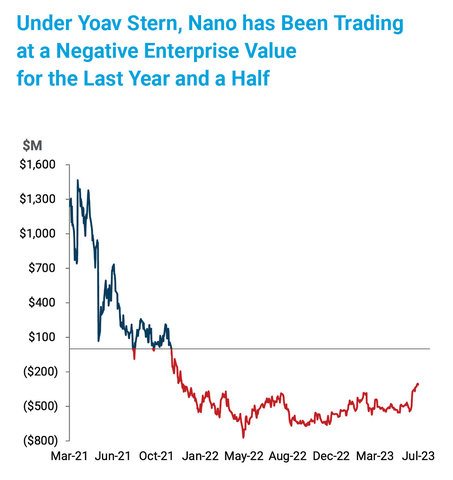

Image 1: Source: Company filings; Enterprise Value accounts for Nano’s investment in Stratasys as of Q3 2022

The full text of the letter follows:

Nano Continues to Make Misleading Claims; Don’t Be Fooled by Yoav Stern

Nano’s Misleading Claims |

The Facts |

Nano will pay Stratasys shareholders $25.00 per share in cash in the partial tender offer. |

Due to the mechanism of the partial tender offer, you will be able to sell only ~40% of your shares for $25.00, assuming full participation in the offer.

Stratasys shareholders who tender risk being left with the majority of their shares and becoming minority shareholders in a Nano-controlled company. |

The partial tender offer value is certain and shareholders will receive their cash IMMEDIATELY after Nano closes its partial tender offer. |

Even Mr. Stern says that Stratasys shares not tendered could trade at $12 or $13 per share.1 If the remaining shares trade at a significantly lower price, the implied total value per share could be ~$16 to $19 or less.2 The timing of any potential closing of the partial tender offer could be months away due to the numerous conditions Nano has placed on its offer. |

If Nano completes the partial tender offer and acquires at least 31.9% to 36.9% of Stratasys, Nano will purchase the rest of the Stratasys shares. |

With the cash that Nano has3, they cannot pay for all of your Stratasys shares at $25.00 per share. They can only buy enough to get to 47%4 ownership in Stratasys. |

Nano’s nominees are highly qualified and bring deep, relevant experience. |

Mr. Stern has acknowledged that his current nominees are not suitable, are interim and will be replaced. Nano’s stagnant board structure indicates that Mr. Stern will likely not replace directors at Nano, so why would he do so with Stratasys? Mr. Stern provides no timetable for this replacement to happen nor any indication as to what these changes will be, which means your investment in Stratasys could be at significant risk for a prolonged period if Mr. Stern and his employees gain control of the Stratasys Board. |

(1) |

Yoav Stern, Nano Business Update Call, 5/30/23. |

|

(2) |

Illustrative pro-rata price assumes all Stratasys shareholders except Nano tender their aggregate 58.9mm shares and maximum of 25.3mm shares purchased as per Nano tender offer (~40% total shares tendered), leaving 33.6mm shares not purchased (~60% total shares tendered); Calculation based on blended value of shares tendered to Nano at $25 per share and illustrative value of remaining Stratasys shares. The 49% of Stratasys shares illustratively trading as Nano-controlled entity assumes for illustrative purposes a $14.88 unaffected Stratasys share price as of 5/24/2023 before announcement of the transaction with Desktop Metal at the upper end and ~40% discount to Stratasys unaffected price of $14.88 implying ~$9 per share at the low end. For the lower end, the ~40% discount to Stratasys unaffected price applied is calculated on the basis of the average 2023 YTD discount of Nano’s share price to its per share value of cash and investments. |

The Stratasys Board reminds its shareholders as to what’s at stake if Nano Dimension Ltd. (“Nano”), a company that has destroyed significant shareholder value, gains control of Stratasys through its misleading and coercive campaign:

- Nano can gain control of Stratasys without paying a penny to Stratasys shareholders, if their Board nominees are elected.

- Shareholders risk becoming minority shareholders in a Nano-controlled company through Nano’s partial tender offer.

- Nano’s partial tender offer implies that your Stratasys shares are valued at ~$16 to $19 per share or less,2 assuming full participation in the offer.

- Nano’s non-independent director nominees, who are almost all Nano employees, may have significant conflicts of interest, and are not qualified to run a company of Stratasys’ scale.

- Nano’s nominees could block Stratasys from engaging in discussions regarding any transactions that would maximize value for Stratasys shareholders.

Dear Stratasys Shareholder,

The Stratasys Annual General Meeting of Shareholders on August 8, 2023 is fast approaching and your vote is critical to ensuring Stratasys can continue to deliver long-term, resilient shareholder value.

Nano has launched a highly opportunistic and self-interested campaign to take control of Stratasys by commencing a partial tender offer and nominating an unqualified group of director candidates to stand for election to Stratasys’ Board of Directors.

(3) |

|

Per Nano’s Schedule Tender Offer, Nano had $957M cash and cash equivalents as at 5/21/23. |

(4) |

|

Assumes Nano maintains minimum cash balance of $150M to account for transaction expenses and expected cash burn and spends remaining cash of $807M to acquire Stratasys shares at $25 per share. Based on 68.6M Stratasys basic shares outstanding. Excludes Nano’s current ownership in Stratasys. |

Vote the WHITE Proxy Card Today |

|

|

| Support the Stratasys Board and VOTE TODAY on the WHITE proxy card “FOR” the re-election of each of Stratasys’ directors and “AGAINST” each of Nano’s unqualified nominees. The Stratasys Board urges shareholders NOT to tender into Nano’s coercive partial tender offer, to withdraw any shares previously tendered and to contact their broker and instruct them to file a Notice of Objection. |

The Facts are Clear: Nano’s Leadership Team Has Destroyed Shareholder Value at an Alarming Rate